On 7 September 2021, Government announced plans to implement a new social care levy, which they claim will raise £12bn a year over the next three years, in order to tackle the NHS backlogs caused by the Covid pandemic and to improve social care services.

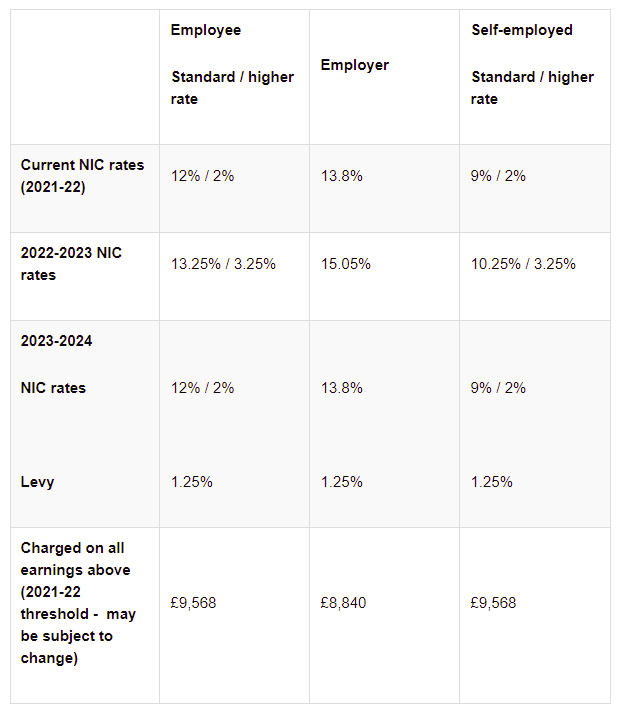

This increase in National Insurance Contributions (NICs) for the 2022-23 tax year will apply to;

- Class 1 (paid by employees)

- Class 4 (paid by self-employed)

- Secondary Class 1 (paid by employers)

Once systems have been updated in 2023-24, a formal legal surcharge of 1.25% will replace the increase in NICs. This will also apply to those working above state pension age.

The changes will also include an introduction of an increased dividend tax from April 2022, which will increase the current rate of 7.5% to 8.75%.

Aspire Business Partnership ("Aspire") provide WK1 with practical and commercially sound advice in relation to all aspects of compliance, business strategy and conflict resolution. WK1 engage Aspire on a retained basis through which Aspire provide WK1 with advice on an ad-hoc basis.