A whole raft of discussion has been taking place regarding the impact of the amended IR35 clauses within the Finance Act 2020 on umbrella companies. This has culminated in a recent meeting involving stakeholder groups and HMRC to discuss the “errant clause” in Section 610 of Chapter 10 ITEPA and a statement from HMRC which can be found here.

Background to IR35

The off payroll working rules apply if a worker (sometimes known as a contractor) provides their services through their own limited company or another type of intermediary to the client.

An intermediary will usually be the worker’s own personal service company.

The rules make sure that workers, who would have been an employee if they were providing their services directly to the client, pay broadly the same tax and National Insurance contributions as employees.

Before April 2021

For workers whose labour user (‘client’) is in the public sector, it is the public sector authority’s responsibility to decide the workers’ employment status.

For workers whose client is in the private sector, it is the intermediary’s responsibility to decide their own employment status for each contract. The private sector includes third sector organisations, such as some charities.

After April 2021

From 6 April 2021 the way the rules are applied will change.

All public sector authorities and medium and large-sized private sector clients will be responsible for deciding if the rules apply.

If a worker provides services to a small client in the private sector, the worker’s intermediary will remain responsible for deciding the worker’s employment status and if the rules apply.

Finance Act 2020 – What changed?

As part of the Finance Act 2020, the Government introduced an amendment to Section 61O of ITEPA 2003, relating to the conditions where an intermediary is a company.

The amendment was introduced as a result of feedback on the draft legislation to protect against arrangements put in place to avoid the material interest condition. i.e. “the worker has a material interest in the intermediary”.

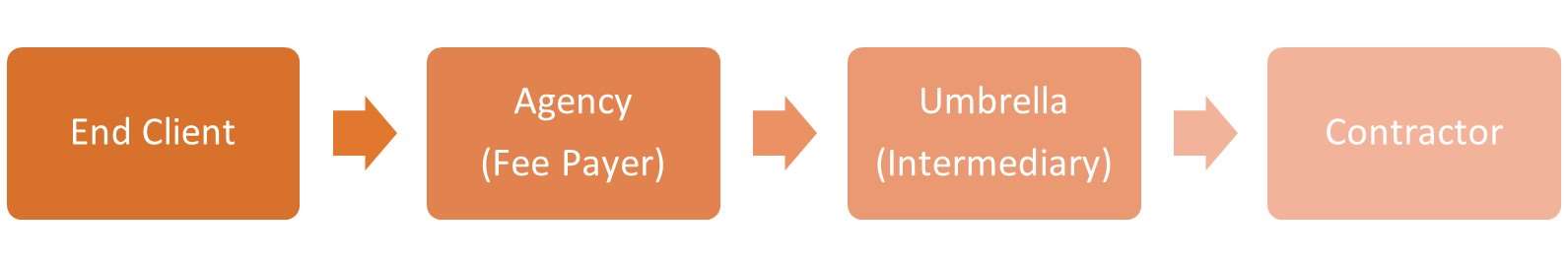

The amendment effectively broadens the definition of an intermediary to “any company that makes a chain payment to a worker”.

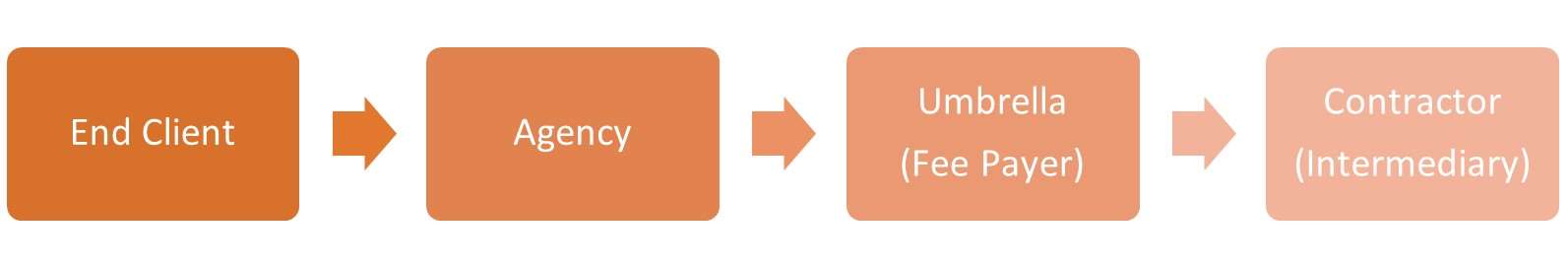

So, in effect, the amendment means that where there is an umbrella company in a supply chain, the umbrella company would effectively be deemed the ‘intermediary’ and the agency in the chain as the ‘fee payer’ for IR35 purposes. This would cause major issues for umbrella companies and agencies.

Before the amendment

After the amendment

What have HMRC said?

HMRC has confirmed that the definition of intermediary in regard to the off-payroll working rules is not intended to include entities such as umbrella companies, employers seconding employees or agencies providing workers where the other conditions of Chapter 10 are met. On this basis it seems amazing that the legislation could have been drafted so poorly as to potentially widen its effect to encompass all of these but the fact that this has been acknowledged is good news!

HMRC state they are actively working with all the relevant stakeholders to determine what action is required to ensure that the rules are applied effectively when they are due to come into force in April 2021.

Aspire Business Partnership ("Aspire") provide WK1 with practical and commercially sound advice in relation to all aspects of compliance, business strategy and conflict resolution. WK1 engage Aspire on a retained basis through which Aspire provide WK1 with advice on an ad-hoc basis.